Tcs

Advertisement

TCS Summit NA v.1.1.0.0

Now in its eighth year, TCS Summit 2012 continues the tradition of gathering together senior business and IT executives, distinguished speakers and influential business leaders for an exclusive and enriching experience. At this three-day forum,

Advertisement

PSS E-TDS v.4 5

This software is specially designed for filing TDS & TCS return in electronic format and can also be used for filing paper returns of TDS in prescribed forms.

Sensys eTDS Express v.9.0

Key Features: - Uses Data maintained in Excel - Show All possible error on the Screen - Generates e-TDS File for Form 24Q, Form 26Q, 27Q & 27EQ(TCS) - Automatic validation by NSDL utility - Generates Form 27A - Generates Certificates Form 16 / 16A -

Checklist Provider Tool v.1.3

A PHP webapp to upload taxonomic checklists as Excel or CSV files to be served as TDWG TCS XML/RDF.

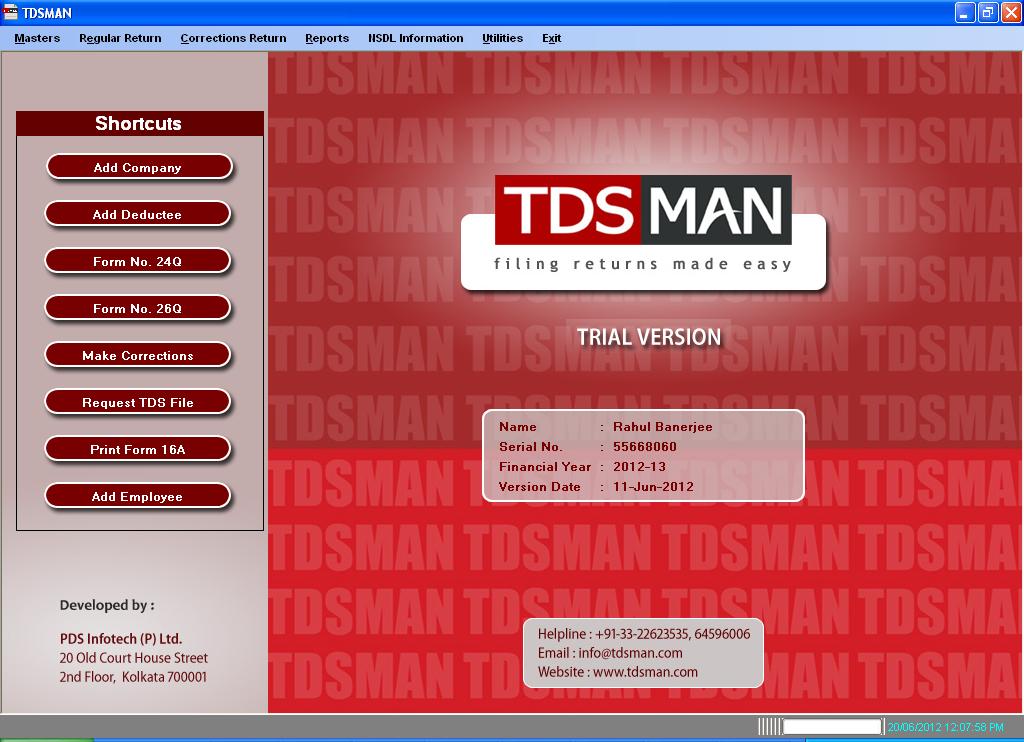

TDSMAN Trial v.1.0

TDSMAN is the complete eTDS & eTCS return filing software exclusively designed as per system specified by the NSDL in line with the requirements of the Income Tax Department, Govt. of India.

ITrax v.5. 2. 2001

Developed specifically for the aviation professional, iTrax™ provides you the ability to track inventory items including serialized and life-limited consumables.

ViTerminal XP v.3.3.0.2415

ViTerminal XP is an independent multifunctional terminal service providing a wide range of opportunities for home, office and system administration.

JS@eTDS (F.Y. 2011-12) - Free Trial v.1.0

JS@eTDS is an ideal software for generating your eTDS / eTCS Quarterly Returns as per the stipulated requirements of the Income Tax Department, Govt.

TDSMAN F.Y.2012-13 v.13

TDSMAN is the complete eTDS & eTCS return filing software exclusively designed as per system specified by the NSDL in line with the requirements of the Income Tax Department, Govt.